Investment Strategies

Edgewood Investment Strategies

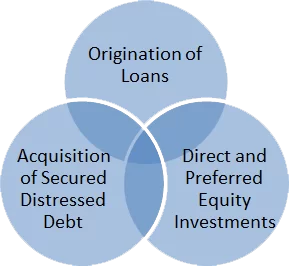

Edgewood Focuses on Three Sectors of Commercial Real Estate Investment

Origination of Loans

Edgewood provides senior and mezzanine debt for special situations including: quick closings, recapitalizations of distressed situations, and flexible capital for the execution of value add strategies.

Acquisition/Financing of Distressed Debt

Edgewood will both acquire and finance the acquisition of distressed debt.

Direct and Preferred Equity Investments

Edgewood will invest alongside real estate entrepreneurs as preferred or GP equity. Edgewood will also invest directly into projects.

Interested in working with Edgewood?

Whether you’re a real estate entrepreneur seeking a custom capital solution or a seasoned investor looking for high yielding, secured exposure to real estate, Edgewood Capital could be the right source for you. Our team builds lasting partnerships by approaching every opportunity with unwavering professionalism and a commitment to excellence. Contact us today to learn how Edgewood’s programs can help you achieve your long-term financial objectives.